EMV Information

What Is EMV? | EMV Solutions | Key Dates | Frequently Asked Questions

EMV is a security framework that defines the payment interaction at the physical, electrical, data and application levels between chip cards and payment devices. These interactions are often referred to as EMV Level 1 and 2 requirements. EMVCo was created by the payment networks to be a neutral party in making this standard framework.

How Does it Work?

Smart cards are embedded with a chip that is encrypted with data. EMV-enabled devices have the ability to read data stored on a chip within the card. During the transaction authorization process, strong cryptographic functions are used to validate the authenticity of the card and cardholder.

Best of all, when a customer pays using an EMV-enabled device, the device is instantly identified as an authentic, approved payment instrument through a process called dynamic authentication. When used with a PIN, the chip proves that the customer is paying with his or her own card.

By using chips as an active part of the payment transaction, EMV cards and devices help prevent credit card fraud from stolen account numbers and cloned payment cards.

Let Verifone Be Your Guide

Verifone, the leader in integrating EMV into payment solutions worldwide, is the perfect partner during this transition. We have years of experience helping thousands convert to EMV with hardware, software and managed services.

Unmatched Product Lines and Extraordinary Security

The complexity of migrating to EMV chip-card standards can pose significant challenges for acquirers and merchants. Verifone provides an unmatched line of EMV-compliant hardware and software - as well as training and support - to deliver complete solutions for meeting migration plans. In addition, we are working closely with our partners to ensure that all payment applications designed to run on these devices will be EMV-certified. Moreover, you can use our VeriCentre Estate Management or our Verifone HQ solutions to centrally manage your estate of devices to handle simultaneous downloads efficiently at the least disruptive times. EMV applications will need to be downloaded into your devices in a quick and efficient manner.

Most importantly, while EMV limits the exposure of payment transactions to fraud and misuse, cardholder information is still transmitted in the clear during an EMV transaction. Verifone's VeriShield Total Protect, Secured by RSA, applies sophisticated encryption and tokenization to secure cardholder information, from insertion to processing and back.

VERIX

Verifone's EMV module handles all the necessary EMV application functions, so programmers don't need to worry about creating custom EMV code. The Type Approved module can be "plugged in" and used as is, without the need for any modifications or updates that would necessitate going through the Type Approval process again. This enables developers to quickly and easily implement smart card-supported payment applications for issuers and retailers as required.

MX Solutions

Whether you're upgrading your retail POS terminals for PCI compliance, preparing for EMV, taking on a new capability such as mobile retailing, or looking to completely revamp your retail POS system, we can help. For more than three decades, we've been innovating retail POS payment solutions to anticipate the unique needs of some of the largest retail enterprises in the country.

- Comprehensive customized retail point-of-sale solutions from back-office enterprise management to mobile retailing

- Services and solutions to guide you and support you

- Secure retail POS solutions to protect your customers and reduce your compliance scope

The MX Series includes fully customizable payment solutions that engage consumers with multimedia, in-store promotions, digital coupons and offers. The MX 800 and MX 900 Series stand up to the most demanding retail conditions. With chemically-hardened screens that resist scratching and long-life keypads, it's built to last.

Learn More

Verifone Makes Migrating to EMV Smooth

The easiest way to migrate to EMV is to rely on Verifone. Verifone's experts save additional time and labor costs related to payment estate assessment by determining which EMV-compliant hardware and software solutions best optimize business needs and meet EMV migration initiatives.

By working with Verifone, enjoy the peace of mind of being equipped with everything needed to meet migration plan deadlines and avoid potentially significant risks associated with solutions that are not EMV-compliant.

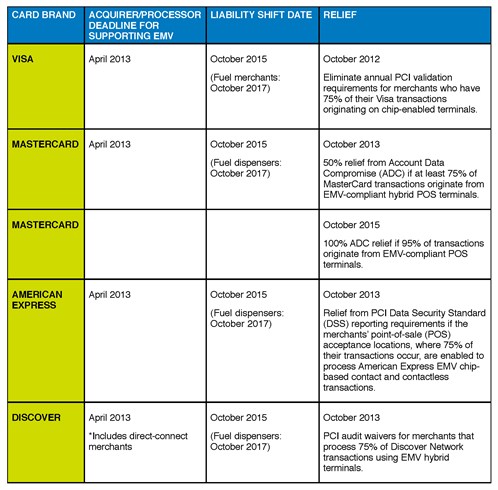

US Key Dates

What do the dates mean?

Payment card networks in the US have provided guidance on how EMV is to be implemented and the incentives associated with migration to EMV for all payment card participants which includes merchants, acquirers and issuers. The key date chart provides a summary of those incentives.

Questions & Answers from Recent EMV Webinars

Q: I have heard that PIN might be required for all credit (not debit only transactions) is this true?

A: No, Chip & PIN is only required for issuers that decide to use it as their CVM (cardholder verification method).

Q: Will merchants be required to buy PIN pads?

A: Merchants are required to purchase PIN pads for PIN debit acceptance. Merchants need a device capable of EMV contact and contactless.

Q: Will all merchants have to have a 2nd separate contactless terminal in addition to a standard terminal?

A: No, merchants should have one device that supports both EMV contact and contactless.

Q: Is contactless going to be necessary for the average small business or is this really just for grocery lanes and customer facing businesses?

A: According to the brand EMV incentives, POS devices for all merchants need to support both EMV contact and contactless.

Q: Will all smart card able terminals be EMV ready?

A: Processors that are class A or class B certify specific devices and PIN pads for applications that support their host. Please visit the www.verifonezone.com homepage for processor certifications by device type.

Q: If the chip doesn’t work properly, would the merchant be required to still accept the card via mag stripe? If so, who’s liable?

A: The terminal will perform “fall back” processing and process the card using the magnetic stripe. According to the card brand rules, this qualifies the merchant for the EMV incentives.

Q: How or whom determines if the EMV transaction is Chip/PIN or Chip/Signature?

A: The issuer will determine the CVM and issue either EMV Chip & PIN, EMV Chip & Signature or EMV Contactless (which can be tapped).

Q: What if the hardware is EMV capable but the application is not yet EMV certified?

A: A merchant must have a POS device that is EMV contact and contactless “capable” and therefore must have the application to qualify for the brand incentives. Capable would mean that the POS device is able to process an EMV transaction.